Elevra Lithium (ELVR)·Q2 2026 Earnings Summary

Elevra Lithium Cuts FY26 Guidance as Mining Challenges Offset Record Revenue

January 27, 2026 · by Fintool AI Agent

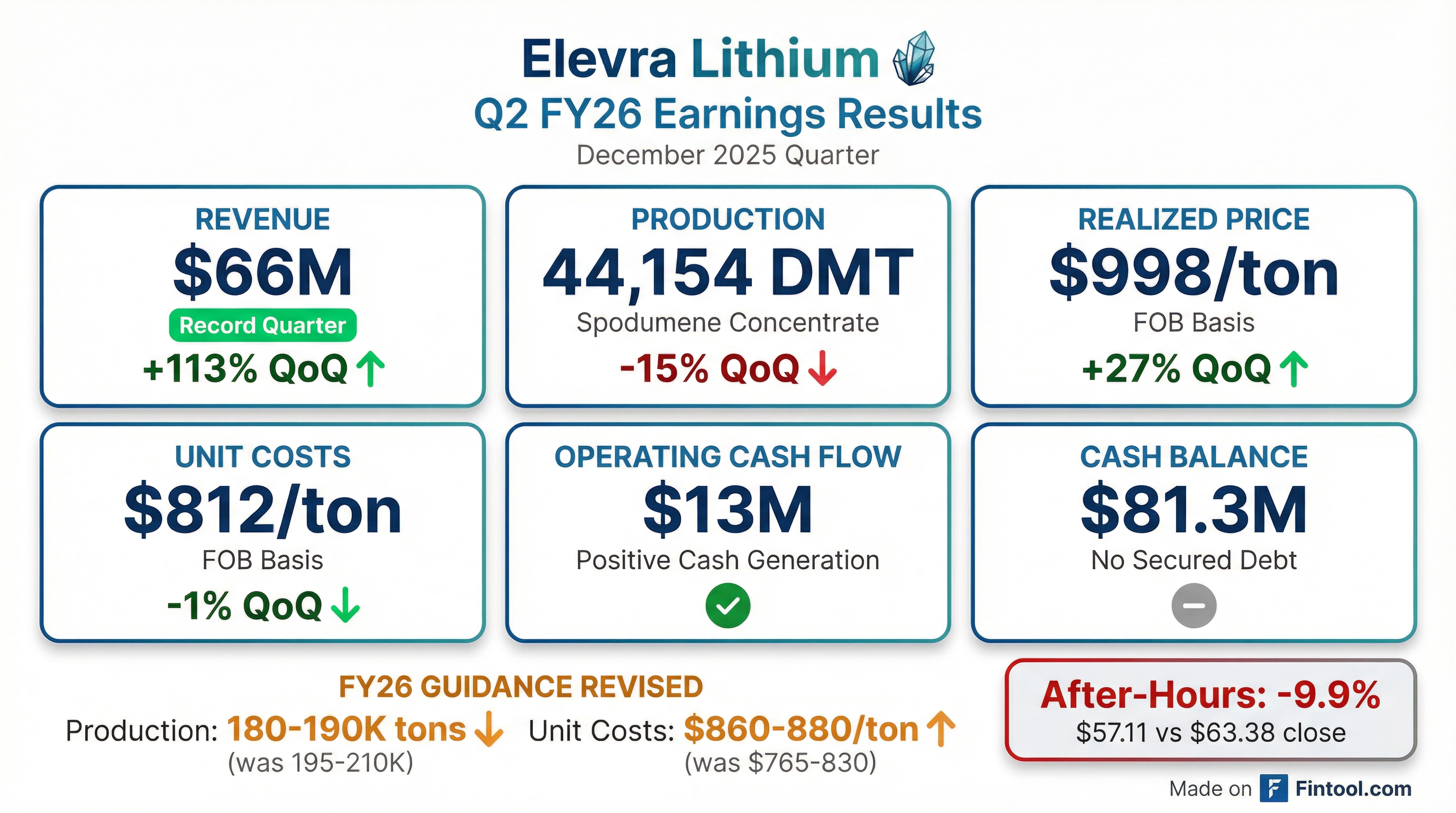

Elevra Lithium delivered its strongest revenue quarter ever at $66M, benefiting from a 27% surge in spodumene prices, but the celebration was short-lived as management slashed FY26 production guidance by approximately 10% due to operational challenges at its flagship North American Lithium (NAL) operation. The stock plunged nearly 10% in after-hours trading as investors weighed the near-term headwinds against the company's leverage to rising lithium prices.

Did Elevra Beat Expectations?

With no street consensus coverage for Elevra, the quarter is best measured against management's own guidance and sequential trends:

The 113% revenue increase was driven by deliberate sales timing—management weighted shipments to Q2 to capture higher forward prices—and a meaningful lift in spodumene concentrate pricing. However, production declined 15% as mining moved into challenging areas with lower grades and higher iron content.

What Happened at NAL?

The production miss stems from geological challenges as NAL mining progressed into areas adjacent to historical underground workings. CEO Lucas Dow explained:

"We've had a convergence of a couple of factors... the geological model had served us very well previously. What we've seen with these narrower veins that are adjacent to the underground workings is that we need to increase the amount of drilling."

Key operational issues:

-

Lower Feed Grade: Mill feed grade dropped to 0.98% from 1.14% in the prior quarter, as mining encountered lower-grade areas supplemented by stockpiled ore

-

Higher Iron Content: Elevated iron levels required increased use of wet high-intensity magnetic separators (WHIMS), which negatively impacted lithium recovery

-

Recovery Decline: Lithium recovery fell from 69% to 62%—the lowest in over a year

Management emphasized these issues are "transitional, not structural" and represent less than 2% of NAL's overall life-of-mine volume. The underground stopes will be fully mined through within the next couple of years.

What Did Management Guide?

The FY26 guidance revision was the headline disappointment, with production and sales targets cut approximately 10%:

The elevated unit cost guidance reflects "additional short-term expenditure associated with ore mining, ore blending, stockpile management, and grade control initiatives."

Management expects the most challenging mining conditions for approximately 2.5 more quarters, with feed grade improving to around 1.03% in the current (March) quarter and iron content also decreasing. Return to 5.2-5.25% concentrate grades is expected during FY27.

How Did the Stock React?

ELVR shares dropped sharply in after-hours trading despite the record revenue quarter:

The sell-off reflects concerns about the guidance cut and near-term operational uncertainty. However, the stock had rallied strongly in recent weeks—up from $52 at year-end—riding the lithium price recovery. Even after the after-hours drop, ELVR remains well above its 50-day moving average of $47.64.

What Changed From Last Quarter?

Positives:

- Record revenue of $66M, up from $31M, driven by higher prices and deliberate sales timing

- Operating profit of $12M at NAL and positive operating cash flow of $13M—first time generating cash since the pricing downturn

- Stable unit costs at $812/ton despite production challenges

- Expansion pathway accelerated: Announced staged approach to NAL brownfield expansion that can bring production online faster

Negatives:

- Production declined 15% to 44,154 DMT, lowest in four quarters

- Recovery rate plunged from 69% to 62%

- FY26 guidance cut ~10% on both production and sales

- Cash declined from $97.9M to $81.3M, partly due to $14M in non-recurring merger transaction costs

Key Management Quotes

On the operational challenges:

"We're probably in one of the more challenging areas of the mine right now, and we'll move through it. So it's not explicitly the underground stopes. It's the combination of the underground stopes with the geological modeling."

On the timeline for recovery:

"Probably the next 2.5 quarters are sort of harder going in terms of the higher iron content and grade being a little lower than the life-of-mine average... the most challenging quarter behind us, but still some work that we're going to really have our shoulder to the grindstone on."

On leverage to lithium prices:

"At current pricing, we'll be profitable at group level, not only at NAL. And that will also allow us to allocate capital for sustaining purposes as well as continuing on with some of the growth projects."

Capital Position & Growth Projects

Elevra ended the quarter with $81.3M in cash and no secured debt obligations.

Growth project updates:

Management noted active engagement with the U.S. Department of Energy, Department of War, and National Security Council regarding the Carolina project, which is one of only two hard rock spodumene deposits in the United States.

Forward Catalysts

-

NAL Expansion Scoping Study (Q3 FY26): Updated study with staged capital approach expected early next quarter

-

FY26 Interim Results (February 2026): Will include details on cost synergies from the Sayona-Piedmont merger

-

Grade/Recovery Improvement: Management expects feed grade improvement to ~1.03% in current quarter, with gradual recovery normalization

-

Lithium Price Environment: Spodumene prices have continued rising into late January; if sustained, profitability should improve despite higher costs

Bottom Line

Elevra Lithium's Q2 FY26 results showcase the double-edged sword of being a single-asset lithium producer. Record revenue and the return to positive cash flow demonstrate NAL's operating leverage to rising lithium prices. However, the 10% guidance cut due to temporary but persistent mining challenges reminds investors that execution risk remains elevated.

The key question is whether the operational headwinds are truly "transitional" as management claims, or indicative of broader geological complexity. With 2.5 quarters of challenging mining ahead, investors will be watching closely for evidence that recovery rates and grades normalize. The accelerated expansion pathway is a positive signal for longer-term growth, but near-term volatility appears likely until NAL returns to historical performance levels.

View Elevra Lithium company page | Read full Q2 FY26 transcript